Foreclosure can be a challenging and often overwhelming experience, leaving many homeowners unsure about their financial future. However, understanding and effectively managing excess proceeds from a foreclosure sale can be a lifeline in reclaiming financial stability.

This comprehensive guide aims to demystify the process and provide actionable strategies for those looking to navigate post-foreclosure finances.

Understanding Excess Proceeds

Eligibility and Claiming Process

Not everyone is eligible for excess proceeds, and the claiming process can vary by jurisdiction. This segment will delve into who qualifies for these funds and outline the standard procedures for claiming them, providing a step-by-step guide for homeowners to follow.

Legal Considerations

Introduction to Legal Aspects

Navigating the legal landscape of excess proceeds can be daunting. Understanding your rights and the legal framework surrounding foreclosure sales is crucial in claiming what you are owed. This section will explore the key legal considerations and protections available to homeowners.

Seeking Legal Assistance

In many cases, seeking legal advice or assistance can be beneficial. This part will discuss when and how to seek legal help, including tips on choosing the right attorney and understanding the costs involved, to ensure homeowners are well-informed and prepared.

Financial Management Strategies

Introduction to Financial Planning

Once you have successfully claimed your excess proceeds, the next step is effective management. This section will focus on strategies to manage and utilize these funds wisely, aiming to set a strong foundation for future stability.

Investing Your Excess Proceeds

Investing your excess proceeds can be a way to rebuild your portfolio, especially after experiencing real estate foreclosures. This segment will provide insights into various investment options tailored for those recovering from foreclosure, emphasizing risk management and long-term growth.

Understanding how to reinvest securely, particularly after the turmoil of real estate foreclosures, is crucial for a sound economic recovery and future stability.

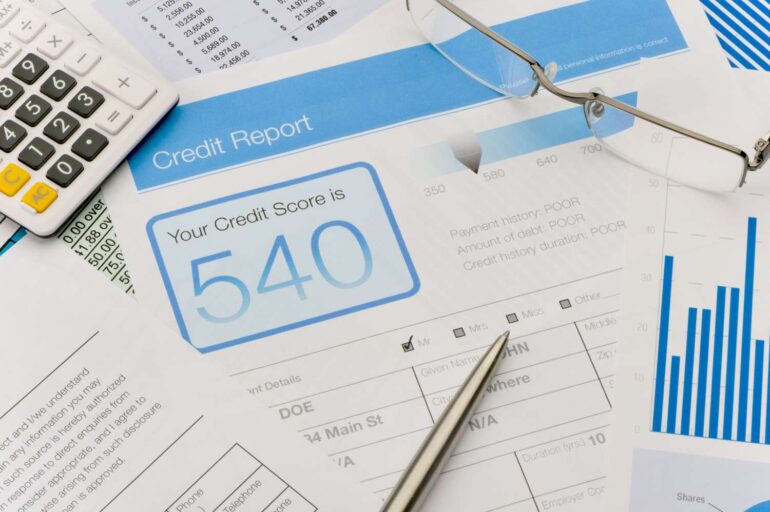

Rebuilding Credit Post-Foreclosure

Introduction to Credit Rebuilding

Foreclosure can significantly impact your credit score. Understanding how to rebuild your credit is essential in regaining economic health. This section will offer practical tips and strategies for improving your credit score post-foreclosure, helping you pave the way toward recovery.

Utilizing Excess Proceeds to Improve Credit

Strategically using it can aid in credit rebuilding. This part will explore how effectively utilizing these funds can positively influence your credit score, providing a roadmap for using surplus proceeds to improve your financial standing.

Tax Implications of Excess Proceeds

Introduction to Tax Considerations

People frequently overlook the tax ramifications of surplus revenues. To prevent unforeseen liabilities, it is essential to comprehend them. The tax ramifications of obtaining extra revenues will be explained in this section so that homeowners are ready for any tax obligations.

Consulting with a Tax Professional

Navigating the complex world of taxes can be challenging. Seeking guidance from a tax professional can be invaluable in the case of real estate foreclosures. This segment will discuss the benefits of consulting with a tax expert, offering advice on finding the right professional, and preparing for your consultation.

Developing a Long-Term Financial Plan

Introduction to Long-Term Planning

The journey to stability doesn’t end with managing surplus proceeds; it’s crucial to develop a long-term plan. This section is dedicated to guiding you through the steps of creating a sustainable plan that aligns with your future goals and objectives.

Understanding the importance of long-term planning and how it can transform your financial outlook post-foreclosure is vital for a secure economic future.

Setting and Achieving Financial Goals

Setting realistic goals and mapping out a plan to achieve them is the cornerstone of long-term stability. This part will delve into techniques for goal-setting, prioritizing objectives, and implementing a step-by-step plan to reach these goals.

Whether it’s saving for retirement, buying a new home, or securing an education fund for your children, having a clear set of goals and a plan to achieve them is essential for long-term success.

Embracing Financial Education and Literacy

Introduction to Financial Education

Financial literacy is a key component in successfully managing your finances, especially after experiencing foreclosure. This section will emphasize the importance of financial education in making informed decisions about your money.

It will provide resources and tips for enhancing your understanding of concepts, which is crucial for anyone looking to take control of their economic future post-foreclosure.

Tools and Resources for Financial Empowerment

Empowering yourself through education and resources is a proactive step toward financial independence. This part will introduce a range of tools, resources, and educational platforms that can enhance your financial literacy.

From online courses and workshops to books and financial counseling services, various options are available to help you understand and manage your finances more effectively. This knowledge not only aids in immediate financial decision-making but also prepares you for future financial challenges and opportunities.

Navigating Emotional and Psychological Impacts of Foreclosure

Introduction to Emotional Recovery

Foreclosure is not just a crisis; it can also take a significant emotional and psychological toll. Understanding and addressing these impacts is crucial for holistic recovery. This section will discuss the common emotional responses to foreclosure, such as stress, anxiety, and a sense of loss, and offer insights into coping strategies that promote mental well-being alongside monetary recovery.

Seeking Support and Building Resilience

It’s important to acknowledge the need for emotional support during this challenging time. This part will explore avenues for seeking emotional and psychological support, such as counseling, support groups, and community resources.

Building resilience and finding ways to maintain a positive outlook are vital in navigating the aftermath of foreclosure.

Practical tips for nurturing resilience, such as engaging in self-care practices, seeking social support, and maintaining healthy routines, will be covered to help individuals regain their emotional footing and move forward with confidence.

Conclusion

Recovering financially from a foreclosure sale is a journey that requires patience, knowledge, and strategic planning. By understanding the nuances of excess revenues, seeking appropriate legal and financial advice, and employing sound financial management tactics, you can lay the groundwork for a stable and prosperous future.

This guide aims to empower you with the knowledge and tools needed to navigate this challenging phase and emerge with a renewed sense of financial control and optimism.