Look no further if you’ve ever wondered how you can prove your income when self-employed.

Many independent contractors and the self-employed struggle to figure out how they can prove their income whenever they want something like a loan. Fortunately, you can produce pay stubs for yourself that act as legal documentation of your income.

Pay stubs are simple to make and don’t require much information. They outline your income better than a check and provide much more information than a bank statement.

Keep on reading to learn how to make self-employment stubs!

What Are Self-Employment Pay Stubs?

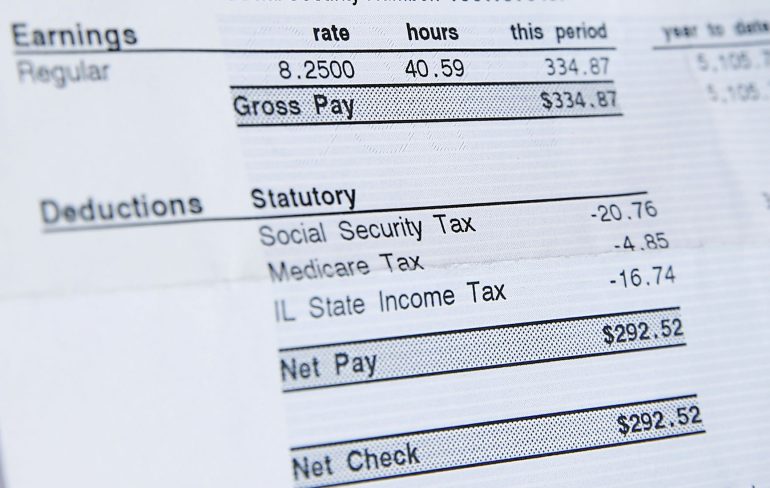

Pay stubs are some of the most common documents people receive when getting paid. Unlike a check or bank statement, they show various details relating to one’s income. You’ll find information about deductions and additions, something you can’t with a check.

While these are generally used to keep track of one’s income, they’re also used when applying for loans. Lenders want to see proof of income before approving someone, so providing them with stubs will give them an in-depth look at how much someone earns.

These are the common loans people request:

- Mortgages

- Car loans

- Lines of credit

An employee would usually receive their stub from an employer. However, it’s possible to produce self-employment pay stubs that provide just as much information. In most cases, you can come up with the one that shows more details about your income because you’ll be able to customize what goes on.

When you file taxes, you can refer to the stubs to ensure that you insert the correct information. Knowing the deductions becomes important because things like Social Security taxes and local taxes need to be registered.

How To Make A Stub?

Making it isn’t difficult, but you’ll need to pay attention to the details you’re using. Pay stubs are legal documents, so everything must be correct. Understanding how to do this will make filing taxes easier, and you can save on fees that would come with hiring an accountant.

Employers provide their employees every salary period. In the case of someone that works for themselves, they’d need to set up a system.

Someone that gets paid upon completion of a project should produce a pay stub after each project. If you have a contract that lasts several months and you’ll be paid throughout it, then make it each time you’re paid.

You can load up any spreadsheet program and start making a template, but it’s best to handle all the calculations before starting. Some of the common things people use are Google Docs and Excel spreadsheets. Aside from making a stub, you can use these to organize your numbers.

1. Gross Pay

Your gross income is essentially how much you’ve earned in a pay period before deductions. Gross pay doesn’t include money taken out for taxes, so you’ll want to ignore them for this step. You can easily find your gross by dividing your annual salary by the times you’ve been paid.

Someone self-employed will have various numbers yearly because they typically won’t have a consistent income. If you’ve only been paid twice a year, you’ll divide your annual salary by two.

So if you’ve earned $40,000 in a year and have been paid twice, your gross pay would be $20,000.

2. Deductions

A deduction is anything that comes out of your paycheck. These include, but are not limited to, Social Security taxes, local and state taxes, and money towards a retirement plan.

Figuring out how much you’ll need to deduct can be tricky, so you should resort to the IRS Employer’s Tax Guide. You’ll find information about all the necessary taxes that you’ll need to pay. Depending on where you live, you may not have to pay local taxes.

Remember that the amount you’ll have to deduct will vary depending on your marital status and whether you’re the head of the household.

3. Net Pay

Net pay is the total amount of income after deductions are made. When you take your gross pay and subtract the money that’s going towards taxes, you’ll come up with the net pay. For example, it could be $17,000 if your gross income is $20,000.

How To Choose A Check Stub Generator?

In a marketplace with dozens of makers, you’d want to know what factors to consider when shopping for one. Here are the major things to look at:

-

User Interface

You wouldn’t want an app that’s too complex to navigate. The friendlier the design, the easier it is for you to use the program.

-

Instant

Indubitably, you need software that generates the document instantaneously. As you know, the world is fast-moving, and it can’t afford to wait several hours for something as simple as a stub.

-

Budget-friendly

Choose an app you can comfortably afford without inflicting financial strain on yourself.

-

Export Format

The most popular export format is PDF. You can easily print or share a PDF document through most file-sharing apps. Furthermore, PDF files consume very little storage space.

Choosing Between An Online Generator Or Spreadsheet Program

Although you can use a spreadsheet program, it may be more convenient to find a stub generator online. You wouldn’t have to worry about formatting; it would tell you what information needs to be filled in.

However, using something like Google Docs would let you share the templates between multiple users. Anything uploaded and made up in Google Docs will stay in the cloud so that you can access it from any device. You’ll essentially have to choose between efficiency and accessibility.

The importance of keeping accurate financial

Keeping accurate financial records is crucial for self-employed individuals as it helps them to effectively manage their business finances and make informed decisions.

By tracking income and expenses, self-employed individuals can have a clear understanding of their business’s profitability and make adjustments as needed to ensure its success. This can be easily done by using invoice generators, and to access one click here.

Accurate financial records also help when filing taxes, as they provide an organized and comprehensive overview of the business’s finances. This can help to minimize tax liabilities and avoid potential penalties from the tax authorities.

In addition, keeping detailed financial records can help when seeking financing or applying for business loans, as lenders will typically require financial statements and other documentation to assess the business’s financial health.

Start Making Self-Employment Stubs Today

Now that you know how to prove income when self-employed, you can start making stubs! They can be made within minutes, providing that you’ve made all the necessary calculations. These documents are crucial if you’d like to show proof when self-employed.

Before starting, start calculating your gross income, deductions, and net worth. Include your personal information when filling out the stub, such as your name, address, etc.